The terms GameFi 1.0, 2.0, and 3.0 refer to the iteration of GameFi titles as they move from earliest and least sustainable to more sophisticated as the industry evolves.

While tokenomics of different projects are a significant factor (e.g., the number of coins within the game), others, like funding and game quality, are also critical.

This report will highlight the positive developments and shortcomings of GameFi 1.0 to propose what a future GameFi 3.0 might look like.

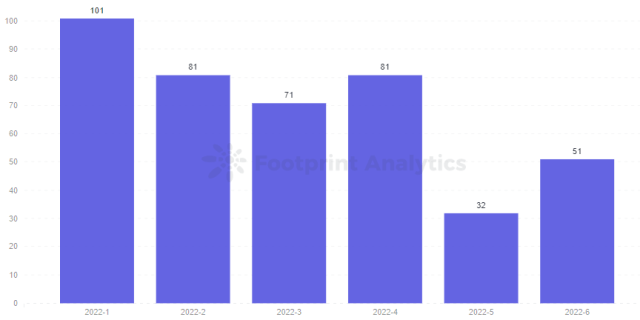

It’s been more than a year since GameFi took off, and from a rapid upward climb in user numbers in the last quarter of 2021, it began to taper in early 2022, with a noticeable drop in February.

With the global base of 3 billion gamers failing to flock to Web3 and the short lifespan of most GameFi projects, it is critical to ask how this industry can become more sustainable going forward.

Three Findings in GameFi Development

Projects that develop fast usually sacrifice quality

GameFi is a mixed bag, and there is no shortage of fork projects hoping to make an easy buck. Between 70% and 80% of GameFi projects in the market are not active, with an average of 200 users per day for 5 consecutive days. Even though 80% or more of the projects launched in 2022 were active within 30 days of launch, the data indicates they are failing to last long.

Most projects fail to remain active

Data shows that 60% of projects die within 30 days of being active, and few projects have been active for more than three months since last November.

Most games go from launch to active quickly but don’t stay active for long.

Chains differ in their development paths

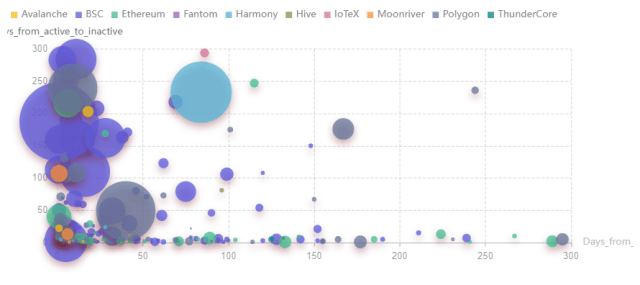

The chart below shows how quickly projects reach active status after launch. The X axis is the number of days a project takes from launch to active status, the Y axis is the number of days spent in active status, and the bubble size is the total number of users.

With Splinterlands, HIVE stands out from the rest, as it has been active since its launch and is still going strong, making it the larger yellow bubble in the top left corner.

Ethereum is not GameFi-friendly in terms of gas fees and transaction efficiency, which makes it less than ideal for the GameFi space. Many projects have long initial climbing periods, short active time, and low total users. But it has a strong foundation, and maybe after solving these problems, more quality games will come online to give it a broader market share in GameFi.

On the other hand, BNB’s projects are more likely to break out quickly, have a medium duration, and perform relatively well in terms of user numbers. Polygon is moderate, and ThunderCore shows a surprisingly long duration of activity.

In addition to the bear market, GameFi’s structural problems have contributed to the current situation. This report will attempt to uncover the causes of these problems and explore the possible future of GameFi.

Structural issues with the GameFi 1.0

The Death Spiral in GameFi 1.0

GameFi 1.0, a category in which Axie Infinity was dominant for a long time, revolves around Play-to-Earn.

Despite differences in gameplay (e.g. staking, tower passing PVE, card battling PVP) or tokenomics (single token, dual token, token + NFT, token-standard, etc.), these early titles are all Ponzi-like. They rely excessively on a steady stream of incoming funds in an “external circulation” model.

In this model, old players reinvest with the funds invested by new players, and new players keep paying interest and short-term returns to old players to create the illusion that old players are making money.

All the tokens minted by old players need to be consumed by new players, or otherwise, players will keep selling, causing the token flow pool to have only sellers and no buyers. In this case, the token price will enter a death spiral.

As seen from Footprint Analytics data, after steady growth from July to September 2021 and an explosive period from October to November, incoming funds across the sector began to slow down due to the general environment and the impact of individual projects.

Under such circumstances, the external circulation model of GameFi 1.0 quickly became problematic, as out-of-game funds cannot meet the constant demand for in-game funds to generate interest, thus gradually transforming the positive spiral into a death spiral.

Thus, most GameFi 1.0 projects had, or will have, only one cycle, and once the death spiral begins, they cannot be revived. Different models, teams, backgrounds, operations, and environments influence the overall project throughout the process and can produce a variety of cycle patterns.

The cold GameFi winter was as much caused by the industry’s Ponzi-like character as the macroeconomic environment. The growth rate of the overall capital expansion of tokens has not kept up with the demand for capital revenue within the games, creating an inevitable bubble burst.

New Innovations

Some projects began to innovate with economic models and saw a burst of positive activity from February to March despite the poor environment.

Crabada on Avalanche and StarSharks on BSC are the most prominent among them. StarSharks used its support from Binance in the early stage to keep its popularity high, with “Genesis Mystery Boxes”—an in-game NFT—having a high price even before the game was launched.

Unluckily, the game’s launch coincided with the GameFi winter. Therefore, StarSharks had few players in the early stages.

However, StarSharks’ backing, economic model, and game quality—as well as its active community—allowed it to grow steadily throughout Q1. It began to decline gradually after peaking in April.

III. Tokenomics of GameFi 1.0 projects

Tokenomics can determine the life cycle of a project, as can be seen by looking at several different games.

Axie Infinity

Axie Infinity, as the originator of P2E, had unmatched resources and a player community at the beginning of the bull market. Therefore, it was able to maintain a few months of upswing with only the basic dual token model and breeding system. However, it faced a slow decline afterwards yet still retains some loyal users.

BinaryX

BinaryX attracted many users in the early stages because it paid out a lot of APY and returned to early players very quickly.Now it has an inflation problem with its tokens. Once there is not enough revenue, it will immediately enter the negative feedback phase and the number of users will drop rapidly.

However, with the exchange and the project’s control over BNX, the price of the token has rebounded, but there are still very few users.

CryptoMines

The single token model of CryptoMines is pure Ponzi, and its lifecycle shape is representative of most degen projects.

In the early stage of the project, with a very short payback cycle to attract a large number of funds, users and market cap will have a huge pull up. When the bubble blows to the critical point of market capital and emotions quickly burst, the higher it rises the faster it falls.

While the economic models, operating models, and life forms of the projects vary, both the blue-chip Axie Infinity, the degen CryptoMines, and the meta-universe concept The Sandbox all faced trouble in December 2021.

StarSharks

Based on the experience of the former above, StarSharks’ also uses the classic dual token model, with SEA as the main output and SSS as the governing token. This has allowed it to create a small boom in the winter, and its model deserves to be explored even more.

In order to prevent the death spiral caused by infinite inflation of the in-game token SEA like other dual token models, StarSharks turns the requirement to enter the game into consuming SEA to buy a blind box, thus shifting the pressure from token dumping to the NFT pool. So SEA takes the master control effect, and 90% of the consumed tokens are directly burnt, so the circulation of tokens is even less.

The governing token SSS is mainly the empowerment of staking dividends, and its output is not much in the case of its general empowerment role.

From Footprint Analytics, the number of active users has been growing evenly from January to March, indicating that the number of SEAs consumed at the time also increased equally.

However, from the beginning of March, the price of SEA started to trend downward, reflecting the accumulation of several months. The number of SEA minted in the game shows an accelerating trend, and the output is greater than the consumption, highlighted by the price decline.

As it turned out, StarSharks lit the fuse at the beginning of April when the number of users began to fall off a cliff after the cancellation of daily tasks and the rental market. So for the GameFi project, model analysis and data tracking can give some indication of the cycle the project is in.

StarSharks couldn’t escape the death spiral, and the game’s strengths and weaknesses can teach the GameFi space several lessons.

Strengths

-

- GameFi volume is still small, a few hundred active users can revitalize the project in the early stages.

- The project combined with the background narrative, which added to players’ expectations for the GameFi project in March to April, and gained the interest and trust of a large number of users.

- The team successfully seized the turning point of the two periods and adjusted the return cycle of short-term play-to-earn to the stable revenue, with the maintenance of the community and large users, to stabilize the spread of the wealth creation effect.

Weaknesses

-

-

- Although the life cycle has been lengthened, it did not change the overall structure.

- The rhythm of the subsequent new updates did not keep up in time, resulting in the exodus of some profitable users and destroying the balance.

-

IV. What are the possibilities for GameFi’s future?

While everyone was expecting it, GameFi 1.0, which officially entered the second half of the year, didn’t seem to have too bright a performance in Q2. No matter from the number of games or the overall game capital, they all show a slow decline.

So, what kind of model can allow GameFi to develop in the future?

High-quality AAA games

3A games refer to games with high development costs and quality. There is no objective criteria for 3A, so in the GameFi space, games are generally rated based on the strength, background, the vision of the project and the game demo. Currently, recognized 3A games include BigTime, Illuvium, StarTerra, Sidus, Shrapnel, and Phantom Galaxies.

These 3A games have the obvious advantage of often gaining huge attention early in the project, but there are still various issues that players criticize.

- The development process is too slow.

- Content and picture quality are only slightly better than Web3, far from the level of traditional games.

- IDO and INO are not enough to empower game assets.

- Roadmap is ambiguous or not fully implemented.

Some of the projects that have issued tokens have followed the overall GameFi market downhill in the first half of the year.

In the future, there will be a time when 3A games will blossom, with MOBA, RPG, SLG creating different scenes and different content according to their own positioning. Instead of thinking too much about P2E, the game will use interesting gameplay and content to attract users to experience the game and enjoy the unique features enabled by blockchain. Maybe users have to wait for a while, maybe next year Q2, Q3, or even longer, but this is the direction of the market.

Narrative-based X2E products

StepN launched the Move-to-Earn trend. It has also created the “X2E” subcategory, which encompasses various activities that might be compensated via games’ tokenomic models. E.g., Learn-to-Earn, Sleep-to-Earn, Watch-to-Earn, and Sing-to-Earn.

As seen by Footprint Analytics, while other models of X2E are still in the early conceptual stages, M2E’s StepN led the wave in May, and other imitators are popping up all over the place.

However, except for Genopets, which is a game in the mode of Pokémon, other X2E projects such as StepN, SNKRZ, Melody, FitR are more like Web3 products with profit-making attributes, so this piece needs to focus more on the social attributes brought to users.

As a big meta-universe scene, SocialFi is also always what players are looking for. A vast world chat, leaderboard comparison, game activity competition, and guild battle content can all give players meaningful experiences outside of earning.

An evolving finance model

Most blockchain games still revolve around P2E, and the dual token model is the most stable, proven system available. Therefore, the future GameFi model can still use this model, but it also requires a DAO vault and an NFT marketplace.

It is important to note that the NFT marketplace must be the project’s own, so that at least tax revenue is the main source of income for the project at this stage, rather than relying entirely on the money of late-entry players.

Since NFTs will be an integral part of GameFi, project owners can try to make NFT props the main output of the game, whether it is ERC-721, ERC-1155 or a new evolvable protocol like EIP-3664.

The second most important thing is the framework design of the game model, which is related to the sustainability of the project. A simple cycle of token and NFT between improving character attributes like GameFi 1.0 would be too thin. This model is more like a Ponzi framework, where the late-entry money keeps contributing to the front-entry money, and the project developer throws the token pressure to the NFT, which will fall into a death spiral when the NFT pool overflows.

Enriching the game’s ecosystem and extending its lifecycle requires more extensions to the original model both horizontally and vertically. When the power of the game’s own internal circulation is large enough, it will generate the centrifugal force that can get rid of the inertia of being caught in the death spiral.

Horizontal extensions

Horizontal extensions include adding token and NFT output and consumption scenarios. For example, setting the equipment life mechanism and repair criteria; or stratifying the free and P2E players to set different game play styles.

Vertical Extensions

Vertical extension can be split into 2 structures: upward and downward. The upward extension is used to solve the problem that players have too few roles to choose from. 99% of players rely on the single mode of minting and playing to make profits, so more scenarios can be added. For example, add advanced dungeons, PVE, PVP, and these scenarios should be differentiated to give more empowerment through benefits and consensus.

The downward extension is different from the upward extension, which lengthens the life cycle by significantly increasing the number of props and gameplay. Such as increasing the pieces of props, gems and thus increasing the enchanting, melting function, downward framework can draw a lot from the traditional game play.

Summary

GameFi 1.0 has gone through a cycle that confirms that Web2 and Web3 players still have very different attributes. Ponzinomics can attract traffic at the beginning of a project, but it is not feasible to rely only on the external circulation model, and if the project can’t find its own internal circulation to absorb the previous bubble it will be hard to escape from the death spiral.

Most current GameFi projects are still not playable and do not reflect the advantages of blockchain in terms of technology. Therefore, a transitional GameFi model can only be built from the perspective of Web3 users and economic models. The lifecycle of the projects is not long, and the development of chains is not ideal. Some chains have many games but poor volume, while others have a hot game but an unbalanced on-chain ecosystem.

The future of GameFi needs to find a way to improve content, gameplay and tokenomics.

August 2022, Footprint Analytics × W Labs, Data Source: Footprint × W Labs GameFi Report Dashboard

The post What will future GameFi models look like? appeared first on CryptoSlate.